2021 federal income tax calculator

Use this federal income tax calculator to estimate your federal tax bill and look further at the changes in 2021 to the federal income tax brackets and rates. Based on your projected tax withholding for the year we can also estimate.

Tax Withholding Calculator For Employers Online Taxes Irs Taxes Federal Income Tax

Estimate your US federal income tax for 2021 2020 2019 2018 2017 2016 2015 or 2014 using IRS formulas.

. Federal Employees Group Life Insurance FEGLI calculator. Plan Ahead For This Years Tax Return. Personal Finance Insiders free federal income tax calculator estimates how much you may owe the IRS or get back as a refund when you file your 2021 tax return.

Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that. Use Tax Calculator to know your estimated tax rate in a few steps. The lowest tax bracket or the lowest income level is 0 to 9950.

Use the Simple tax calculator to work out just the tax you owe on your. A few obvious suggestions. 2022 Simple Federal Tax Calculator Enter your filing status income deductions and credits and we will estimate your total taxes.

Ad Accurately file and remit the sales tax you collect in all jurisdictions. Our free tax calculator is a great way to learn about your tax situation and plan ahead. Tax filing status Taxable gross.

Ad Guaranteed Results From A BBB Firm With 28 Years In Practice. It is taxed at 10 which means the first 9950 of the money you made that year is taxed at 10. Federal Income Tax Return Calculator Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax.

Use this federal income tax calculator to estimate your federal tax bill and look further at the changes in 2021 to the federal income tax brackets and rates. 2021 Simple Federal Tax Calculator Enter your filing status income deductions and credits and we will estimate your total taxes. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Many index funds are low-churn and tax. They also must be either your child one of your siblings your foster child or a child. Based on your projected tax withholding for the year we can.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. 1040 Tax Calculator Enter your filing status income deductions and credits and we will estimate your total taxes. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Use our 1040 income tax calculator to estimate how much tax you might pay on your taxable income. Income Filing Status State More options After-Tax Income 57688 After-Tax.

Based on your projected tax withholding for the year we can. Knowing which tax bracket you are in can help you make better financial decisions. You want to pay the long term capital gains rate and pay that as infrequently as possible.

TAXCASTER Tax Calculator 2021 Estimate your refund with TaxCaster the free tax calculator that stays up to date on the latest tax laws. 1 Dont Churn Your Portfolio. Easily manage tax compliance for the most complex states product types and scenarios.

0 Estimates change as. The calculator will calculate tax on your taxable income only. Ad Guaranteed Results From A BBB Firm With 28 Years In Practice.

Estimate Your Taxes For Free And Get Ahead On Filing Your Tax Returns Today. Ad Get Ready for Tax Season Deadlines. See how income withholdings deductions and credits impact your tax refund or balance due.

Updated for Tax Year 2021 January 31 2022 0408 PM. We can also help you understand some of the key factors that affect your tax return estimate. Know Your OptionsSpeak To One Of Our Experienced CPA IRS Enrolled Agents Now.

Free step-by-step webinar September 19. Ad Estimate Your Tax Refund w Our Tax Calculator. The next six levels are.

Free Income Tax Calculator - Estimate Your Taxes - SmartAsset Calculate your federal state and local taxes for the 2021-2022 filing year with our free income tax calculator. The earned income tax. Use our calculator to estimate your 2021 taxable income for taxes filed in 2022.

To qualify a child must be under age 6 at the end of the year. Know Your OptionsSpeak To One Of Our Experienced CPA IRS Enrolled Agents Now. Current contributions mean you will retire with R2923538 at age 65.

Try now for Free. Up to 10 cash back Estimate your tax refund using TaxActs free tax calculator. Find and Complete Any Required Tax Forms here.

The earned income tax credit or EITC is available to taxpayers with low to moderate income. In 2021 the tax credit is up to a 3600 per child.

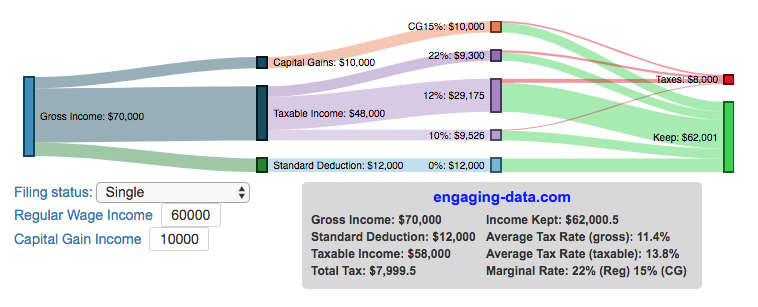

Understanding Tax Brackets Interactive Income Tax Visualization And Calculator Engaging Data

How To Calculate Payroll Taxes Methods Examples More

How To Calculate 2021 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Understanding Tax Brackets Interactive Income Tax Visualization And Calculator Engaging Data

Florida Income Tax Calculator Smartasset

How Much Does A Small Business Pay In Taxes

Paycheck Taxes Federal State Local Withholding H R Block

Tax Calculator Estimate Your Taxes And Refund For Free

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

2022 Income Tax Withholding Tables Changes Examples

Excel Formula Income Tax Bracket Calculation Exceljet

Inkwiry Federal Income Tax Brackets

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet